Services

Services

INCOME TAX PREPARATION

We Do Taxes!

Zamora Tax & Immigration specializes in accounting and tax preparation for a wide variety of clients. We specialize in the following:

- Tax return filing and tax planning for individuals

- Bookkeeping and financial statements for small businesses

- 1 Day Tax Preparation Service ( Same Day)

- Open Year Round ( With 19+ years in the tax business)

- 1040 EZ- $75.00

- 1040A- $85.00

- 1040- $125.00

- 1040 With Schedule C, CEZ or 2106- $235.00

- Bank Products- $145.00

HABLAMOS ESPAÑOL

Annual participation in Continuing Professional Education courses offered by local chapters of national accounting and tax associations keeps the firm on the leading edge of ever-changing tax laws and accounting methods. Computarized offices and Internet access ensures clients accurate, efficient, state-of-the-art service at a competitive price.

Feel free to contact the office anytime. We're here to help you.

Zamora Tax & Immigration also offers banks products and free electronic filing with paid tax preparation. Other services include direct deposit into a customer's checking account. Zamora Tax & Immigration wants to help you through the next tax season. Do not give the IRS more than their fair share! Take advantage of our experience. Walk-in with your tax paperwork and walk-out with a check and a paperless tax return.

Services Offered

Accounting:

Bookkeeping

Complete bookkeeping services for small businesses

Financial Statements

Monthly, quarterly and year end Balance Sheet and Operating Statements are prepared accurately and timely for a broad range of small business clients.

Payroll Services

Total payroll services for small business clients we work with Adp®.

Other Services:

Financial Planning

Full service Financial Planning for future goals.

What Should You Bring To Your Tax Interview?

PERSONAL INFORMATION FOR EACH FAMILY MEMBER:

1. Name

2. Date of Birth

3. Social Security Card

4. Last Year's Tax Return

5. Valid Driver's License

2. Date of Birth

3. Social Security Card

4. Last Year's Tax Return

5. Valid Driver's License

INCOME AND TAX INFORMATION:

1. W-2s

2. Interest (l099-INT)

3. Dividend Slips (1099-DIV)

4. Stock Sales (1099-B or Broker Statement)

5. Self-Employment Income

6. Sale of a Personal Residence

7. Rental Income

8. Sale of any Business Assets

9. Gambling or Lottery Winnings

10. State Income Tax Refund

11. Pension Income (1099-R)

12. Estimated Taxes Paid

13. Social Security or Railroad Retirement

14. IRA or 401(k) Distribution

15. Unemployment Compensation

DEDUCTIONS/ADJUSTMENTS:

1. Medical Expenses

2. Real Estate or Personal Property Taxes

3. Mortgage Interest

4. Charitable Contributions

5. Employee Business Expenses

6. Gambling Losses

7. Moving Expenses

8. Traditional IRA Contributions

9. Higher Education Expenses

Electronic Filing Service

- It is SO easy, no wonder over 150 million people use it!

Zamora Tax & Immigration is an authorized IRS E-file provider. We provide both Federal and State Income Tax Electronic Filing of your income tax returns. Our tax professionals at Zamora Tax & Immigration pride ourselves on keeping up with the latest tax law changes. We can prepare your taxes and then submit them electronically for the fastest refund possible. Tax returns that are filed electronically receive refunds much faster than the traditional paper filing method.

I.R.S. E-file Benefits:

You will receive an electronic confirmation that the IRS has received and processed your tax return. When you file your taxes electronically, you may receive your tax refund within 7 - 10 days.

We can E-file your Zamora Tax & Immigration prepared tax returns, you will receive an electronic confirmation when you use E-file.

EXPERIENCE:

We have been preparing tax returns, simple and complex, for over 19 years.

COMPETENCE:

We are well aware of the tax laws and the latest changes. As the laws change, we pursue interpretations which will be most advantageous for our clients.

ELECTRONIC FILING:

Federal & State Electronic Filing are available to insure a speedy refund. Electronic Filing also insures Proof of Acceptance by the IRS within 48 hours.

LATEST TECHNOLOGY:

Our offices use state-of-the-art computers and the highest quality software to process returns. This ensures a final product that is accurate and clearly presented.

PERSONAL ATTENTION:

Each of our clients is personally interviewed by one of our partners. We review your situation and consider all deductions, credits and allowances available to you. We will take the time to address your questions and concerns.

YEAR-ROUND SERVICE:

We are available throughout the year to assist with any concerns you may have.

Do you need tax help?

Zamora Tax & Immigration has a proven track record for helping people reach the best possible outcome to the frightening prospect of dealing with serious IRS problems. We can effectively protect your rights and provide excellent IRS Representation to solve IRS problems. If your situation is of an extreme nature, we can refer a tax attorney. Don't put it off any longer. Call us today 909-865-3777.

There are several basic tax planning techniques that we can use to help both individuals and small businesses avoid paying excessive tax.

Possible Legal Deductions

We want to make sure you take advantage of all the deductions and credits you qualify for. Review your expenses for the year and sort them using the categories below:

Medical and Dental

- Deductibles paid out-of-pocket

- Doctor, hospital and emergency room visits

- Operations

- Prescription drugs

- Medical and dental insurance

- Long-term care insurance

- Lab and X-ray

- Visiting nurses / in-home care

- Dental expenses

- Glasses and contact lenses, and supplies

- Hearing aids and batteries

- Orthopedic shoes

- Therapy treatments

- Canes / crutches / braces

- Wheelchairs

- Medical miles driven (number of miles)

Employee Business Expenses

- Uniform cleaning

- Work tools

- Union dues

- Safety shoes and gloves

- Job-related educational seminars

- Office-in-home expenses (insurance, utilities, telephone, Internet access)

- Travel expenses while away from home overnight

- Auto mileage

- Meals and entertainment

- Job-seeking expenses

- Employment agency fees

- Job-related publications

- Work-related supplies

Taxes

Real estate taxes / Property taxes

If your mortgage bank pays your taxes from an escrow account, your mortgage interest statement from your bank will likely show real estate taxes paid.

If your mortgage bank pays your taxes from an escrow account, your mortgage interest statement from your bank will likely show real estate taxes paid.

Interest Paid

- Home mortgage interest

- Second mortgage / home equity loan

- Mortgage interest will be shown on a statement from your bank.

- Points paid at closing

- Investment interest paid (margin interest)

Miscellaneous Expenses

- Tax return preparation

- Safe deposit box rental

- Investment expenses (newsletters, research expenses)

- Gambling expenses (deductible only to the extent of gambling winnings)

Educational Expenses

- Tuition

- Books

- Student loan interest

Choosing a Tax Return Preparer

Most tax return preparers are professional, honest and provide excellent service to their clients. But if you pay someone to prepare your tax return, choose that preparer wisely, advises the IRS. Taxpayers are legally responsible for what’s on their returns—even if prepared by someone else.

Here are a few points to keep in mind when someone else prepares your tax return:

- A paid preparer is required by law to sign the return, fill in the preparer areas on the form and give you a copy of the return. WE SIGN EACH AND EVERY TAX RETURN THAT WE PREPARE, NOT LIKE OTHER OFFICES BECAUSE THEY SIMPLY DO NOT HAVE THE LICENSE TO DO IT.

- Before signing, review the complete return to ensure the tax information and your name, address and social security number(s) are correct and that you understand the entries and are comfortable with the accuracy of the return.

-A Third Party Designee Check Box on Form 1040 allows you to designate a representative to speak to the IRS concerning how your return was prepared or about payment and refund issues and mathematical errors.

If you choose to use a paid tax preparer, it is important that you find a qualified tax professional. Unqualified tax preparers may overlook legitimate deductions or credits which could result in you paying more tax than you should. They may also make costly mistakes that could end with you owing additional tax, along with penalties and interest.

Following are some suggestions to consider when hiring a tax professional:

- Avoid preparers who claim they can obtain larger refunds than other preparers, or who guarantee results or base fees on a percentage of the amount of the refund. WE CAN GET YOU THE MAXIMUM REFUND LEGALLY, WE HAVE MORE THAN 19 YEARS OF EXPERIENCE.

- Choose a preparer you will be able to contact after the return is filed and one that will be responsive to your needs. Ask questions and get references from clients who have used the tax professional before. Were they satisfied with the service received? WE ARE OPEN ALL YEAR AROUND.

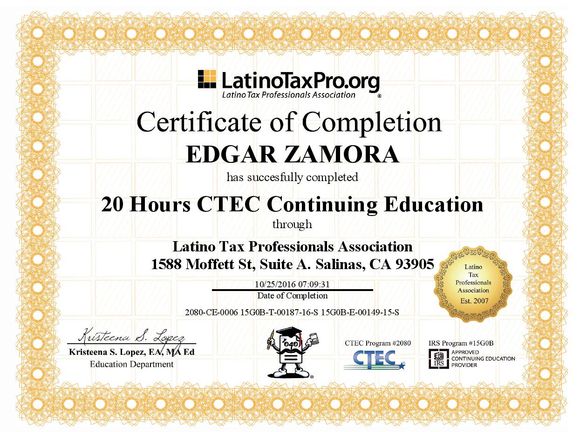

- Check to see if the preparer has any questionable history with the Better Business Bureau, the state’s board of accountancy for CPAs, the California Tax Education Council (CTEC).

Unfortunately, unscrupulous tax return preparers do exist and can cause considerable financial and legal problems for their clients. Examples of improper actions by unscrupulous preparers include the preparation and filing of false income tax returns that claim inflated personal or business expenses, false deductions, unallowable credits or excessive exemptions.

You can check IRS.gov for information regarding tax schemes and scams — including abusive tax shelters. Tax evasion is both risky and a crime punishable by up to five years imprisonment and a $250,000 fine. Remember — no matter who prepares your tax return, you are legally responsible for the information on it. Report suspected tax fraud and abusive return preparers to the nearest IRS office, either by telephone at toll-free 1-800-829-0433 or in writing to the local IRS office.

You can check our credentials through the California Tax Education Council (CTEC).

Telephone: 877-850-2832 or email: info@ctec.org. Our LICENSE NUMBER is A029572.

We are verified by them, licensed and bonded. We at Zamora Tax & Immigration always work hard to help you better.

Useful Links:

Thousands of happy customers trust us.

NOTARY PUBLIC

WE CAN NOTARIZE ALL DOCUMENTS FOR YOU. ONE-STOP OFFICE FOR YOUR CONVENIENCE.

Power of Attorney

Loan Documents

Affidavit

Deeds

Document Preparation

We are a notary public for the State of California and we'll be happy to help with your notary public needs. We help realtors and business people regularly with these services. Our rates are very reasonable and there is no appointment needed. We also have travel services available.

Things You Should Know About Notary Publics:

A California Notary Public is specially trained to identify and legally vouch for the identities of signators. They protect consumers and business people from fraud and are sworn to honesty. Use a notary public any time you want to validate your signature for a remote business transaction.

Many government offices require a notarized signature to process important documents. We can help you to make sure your signature is notarized properly.

Pricing:

We charge $15 per signature. We are certified by the State of California to provide notary public services in Los Angeles County and travel to any county as well. Let us be your notary public of trust.

Affiliations:

Oliver Zamora has been an active member of the National Notary Association since 2005, with experience in notarizing both English and Spanish documents. Mr. Oliver Zamora has notarized Power of Attorneys, Affidavits, Probates, Confidentiality Agreements, Security Placement Affidavits, real property and other legal transactions.

Commision information Los Angeles County Commision # 2200319

Expires on July 02, 2021

Please check our credentials on the following link:

http://www.sos.ca.gov/notary/notary-public-listing

WEDDING CEREMONIES

Notary Public and Issuer of Los Angeles County Marriage Licenses:

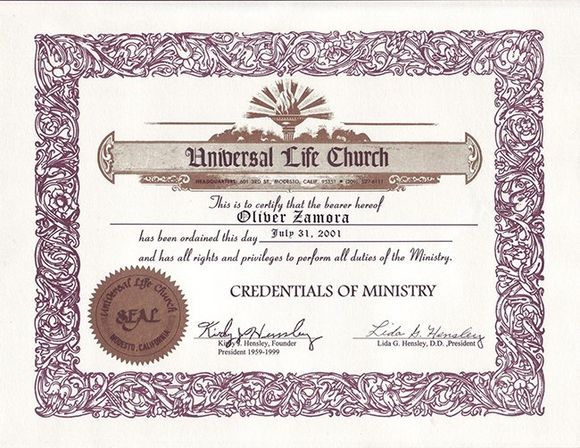

Welcome from Oliver Zamora, Wedding Minister.

We can marry you right now!

HABLAMOS ESPAÑOL

We are located in Pomona, Calif. We have performed hundreds of weddings all over this area. We will do all in our power to make your wedding ceremony memorable and meaningful. As a Notary Public, we can also issue your marriage license if you are getting married at your location or in our beautiful chappel. Immediate Ceremonies.

Minister Available in English or Spanish.

Yes, there is a place you can call today and be married today (as long as you have proper identification). Do not travel to Las Vegas -- you can get it all done here in our office.

We welcome out-of-state couples - as well as out-of-country couples who are here on vacation and desire to get married. We are California Notaries authorized to issue California Marriage Licenses right here in the chapel - there is no need for you to go to a county office to obtain a license since the wait there can be long. The State of California has NO blood test requirement. There is also NO waiting period.

We can issue the marriage license immediately and marry you in the chapel - the whole process takes about one hour. If you prefer, we can also perform a civil ceremony. Bring your own marriage license -- or we will issue you one here.

We marry couples from all over the country, the state and the world in our office. We do many "instant" weddings. No need to travel to the courthouse -- we can issue the license (California allows certain Notaries Public to issue marriage licenses for them) and do a civil ceremony right here -- right now! And remember we issue licenses for weddings we are NOT performing. They are good for 90 days. Call for an appointment and see requirements.

Minister Available in English or Spanish.

Yes, there is a place you can call today and be married today (as long as you have proper identification). Do not travel to Las Vegas -- you can get it all done here in our office.

We welcome out-of-state couples - as well as out-of-country couples who are here on vacation and desire to get married. We are California Notaries authorized to issue California Marriage Licenses right here in the chapel - there is no need for you to go to a county office to obtain a license since the wait there can be long. The State of California has NO blood test requirement. There is also NO waiting period.

We can issue the marriage license immediately and marry you in the chapel - the whole process takes about one hour. If you prefer, we can also perform a civil ceremony. Bring your own marriage license -- or we will issue you one here.

We marry couples from all over the country, the state and the world in our office. We do many "instant" weddings. No need to travel to the courthouse -- we can issue the license (California allows certain Notaries Public to issue marriage licenses for them) and do a civil ceremony right here -- right now! And remember we issue licenses for weddings we are NOT performing. They are good for 90 days. Call for an appointment and see requirements.

MARRIAGE LICENSE REQUIREMENTS - California

The following are the requirements to be issued a Los Angeles County Confidential Marriage License by Oliver Zamora, Minister:

1. You must be at least 18 years of age.

2. You must possess a valid driver's license or state-issued ID card, passport, or military ID -- with picture and signature. A birth certificate alone is not valid identification. These IDs must be valid and NOT expired.

3. You must get married within the next 90 days. If you don't get married in that time period, the license will expire and you must purchase another license.

4. There is NO blood test or waiting period.

5. You must have a third person to perform the ceremony -- ordained clergyperson, judge, retired judge or deputy commissioner of marriage. I AM YOUR MINISTER.

6. If either of you has been divorced in the last two (2) years, you must bring along a copy of your divorce papers.

7. If either of you has been widowed in the last (2) years, bring along a copy of the death certificate.

8. Minors 17 years old and younger must contact the County Recorder's office for the rules of issuance of a license to a minor. We cannot issue a license.

What is a Confidential Marriage License?

In California, there are two types of licenses - the regular license, which requires a witness, and the Confidential, which requires no witnesses. Originally the Confidential was designed (in 1970) so that people living together didn't have to take the dreaded blood test. Now California requires no blood test, but both kinds are still being issued. The Confidential is the only license they allow notaries to issue, and the only kind you can obtain outside of a County Office. At a County Office you can purchase one or the other. But they are only open weekdays, from 8:30 to 4:30 - no holidays. We are open 7 days a week by appointment. So if you get your license from us, it will be the Confidential one that requires no witnesses, and is recorded in private, so that only the bride and groom can get a copy. Some couples dislike it because they can't send mom to get a copy for them at the Recorder's office, others don't like that fact that it states you "have been living together as husband and wife" - so we put this information here for you to choose which type of license suits you. Remember you are just as married with either license.

Call to schedule an appointment right now.

Oliver Zamora, Ordained Minister

Translations

We offer a professional translations from English to Spanish or Spanish to English of documents need for all legal purposes : Immigration services, Registrar Recorder, Courts, etc. We can do summary translations and full translations. The most common documents that We translate everyday are the following : Birth Certificates, Marriage Certificates, Divorces Records, Power of Attorneys, Travel Authorizations, Medical Certificate, Medical Letters, Affidavits, Affidavit of witness, Invitation Letters, School Records, School Certificates and Child Permission Letters. We offer Notarized Translations done by a Notary Public in our office the same day.

Zamora Tax & Immigration

Quick Tax Returns

Su Reembolso Rapido

248 East Monterey Avenue

Pomona, CA 91767

Phone:

909-865-3777

YP Reviews

Miguel A. On 04.10.2017

If you have issues with the IRS or immigration this is your guy. Oliver Zamora has helped me with IRS issues more than anyone else has before. He is a professional and knows what’s he is doing and will...

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited. Terms of Use

| Privacy Policy